Facts About Nifty Chart Uncovered

There are hundreds of equities to choose from, as well as day investors can choose virtually any kind of kind of supply they want. So the first action in day trading is determining what to trade. Once one, or a number of, supplies or ETFs have actually been picked, the next action is generating some ways to benefit from them.

The initial step in day trading is identifying what to trade. When one, or a number of, stocks or ETFs have been picked, the next step is coming up with some means to make money from them. How To Pick Supplies For Day Trading Fluid stocks have big quantity, whereby larger amounts can be acquired and also offered without substantially impacting the price.

Depth is likewise vital, which shows you just how much liquidity a supply has at numerous rate degrees above or listed below the present market quote as well as deal. Day traders need cost motion in order to generate income. Day traders can select supplies that tend to move a whole lot in buck terms or percentage terms, as these two filters will commonly create different outcomes.

The same is real for stocks that tend to move much more than $1.50 daily. While there are those who focus on contrarian plays, a lot of traders try to find equities that relocate connection with their industry as well as index group. This suggests that, when the index or the field tick up, the specific stock's cost additionally increases.

If a trader opts to trade the same stock on a daily basis, it is important to concentrate on that stock, and there is no need to fret concerning whether it is associated with anything else. Day trading is dangerous and requires knowledge, skill, and also technique. If you are wanting to make a big win by wagering your money on your intestine feelings, attempt the online casino.

3 Easy Facts About Intraday Tips Described

Intraday strategies are as many as traders themselves, however by adhering to particular standards and also trying to find particular intraday trading signals, you are most likely to prosper. Right here are five such guidelines. The marketplace constantly relocates waves, and also it is the investor's job to ride those waves. During an uptrend, emphasis on taking long placements.

Intraday patterns do not continue forever, however usually a couple of trades, and also often more, can be made prior to a reversal occurs. When the dominant trend changes, begin patronizing the new trend. Isolating the fad can be the tough part. Trendlines give a straightforward and also helpful entrance and stop-loss method.

More trendlines can be attracted while trading in actual time to see the varying degrees of each trend. Drawing in even more trendlines may supply more signals and may likewise offer better insight into the transforming market characteristics. To select the most effective stocks for intraday trading, the majority of traders will certainly locate it helpful to look at equities or ETFs that have at least a modest to high correlation with the S&P 500 or Nasdaq indexes, and after that separate those supplies that are relatively weak or strong contrasted to the index.

There is even more opportunity in the supply that relocates more. When the indexes/market futures are relocating greater, traders ought to want to get supplies that are going up extra strongly than the futures. When the futures pull back, a strong supply will certainly not draw back as much, or might not even draw back in all.

When the indexes/futures are dropping, it can be rewarding to short sell stocks that drop greater than the marketplace. When the futures move greater within the downtrend, a weak stock will certainly stagnate up as a lot, or will certainly stagnate up at all. Weak stocks offer better profit potential when the market is falling.

Intraday Trading Strategies Things To Know Before You Buy

The following chart contrasts the SPDR S&P 500 to the SPDR Select Modern Technology Fund (XLK). The blue line, XLK, was fairly solid contrasted to SPY. Both ETFs moved higher throughout the day, yet since XLK had such huge gains on rallies and somewhat smaller declines on pullbacks, it was a market leader and also outshined SPY on a loved one basis.

The very same clings short trades. Brief sellers should isolate stocks or ETFs that are fairly weak. This way, when rates fall, you are likely to be in supplies or ETFs that will fall one of the most, hence raising the earnings potential of the profession. Trendlines are an approximate aesthetic guide for where cost waves will start and end.

When getting in a lengthy placement, purchase after the price relocates down towards the trendline and afterwards relocates back greater. To attract an upward trendline, a rate reduced and after that a higher rate reduced is required. The line is attracted connecting these 2 points and after that extended bent on the right.

Short selling in a drop would be comparable. You must wait till the rate relocates up to the downward-sloping trendline, after that when the supply starts to move back down, you utilize this as a trading signal to make your entry. By being person, these 2 long professions provide a low-risk access.

As stated formerly, trends don't continue forever, so there will certainly be losing trades. But as long as a general profit is made, despite the losses, that is what issues. 35.8% The percent of day investors who earn a net revenue over zero after charges, according to one published study.

The Single Strategy To Use For Nifty Chart

Right here are 2 easy standards that can be used to take earnings when patronizing patterns. In an uptrend or lengthy position, take earnings at or a little above the former cost high in the existing trend. In a drop or brief setting, take earnings at or a little listed below the previous cost low in the current fad.

The chart reveals that, as the pattern continues greater, the cost presses with previous highs, which give an exit for each and every particular long setting taken. The exact same technique can be used to sags; revenues are taken at or slightly below the prior price low in the trend. Markets don't always fad.

SERVICES PROVIDED learn this here now

bank nifty chart

nifty chart

nifty live chart

intraday trading

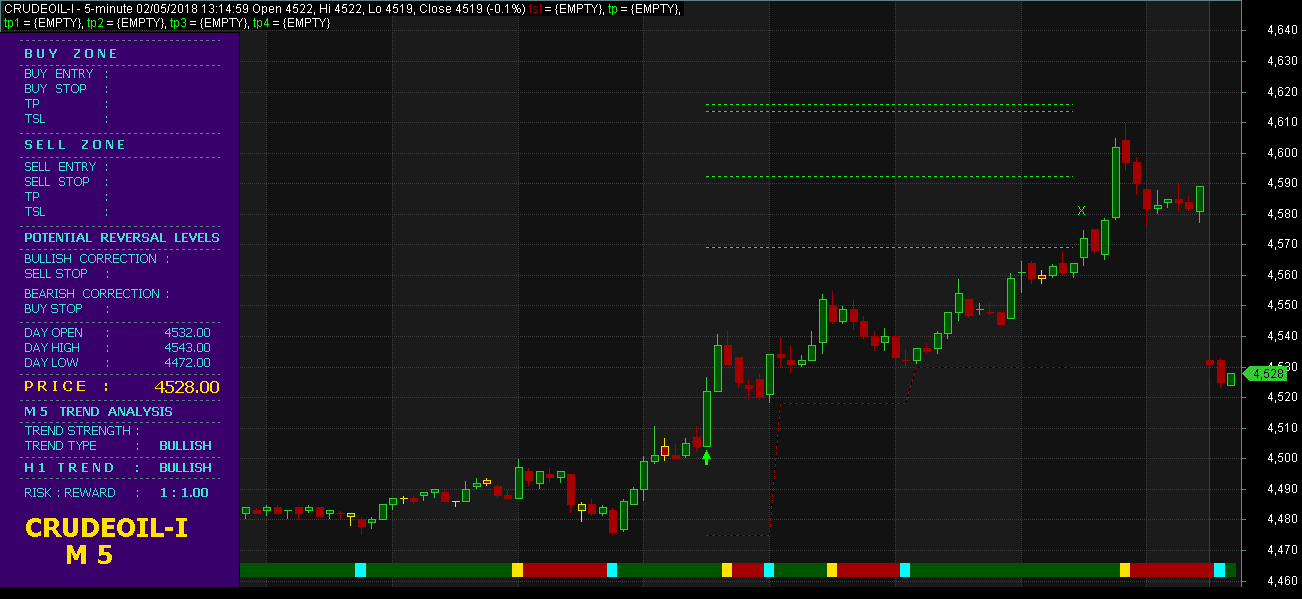

mcx live charts

intraday tips

intraday trading strategies

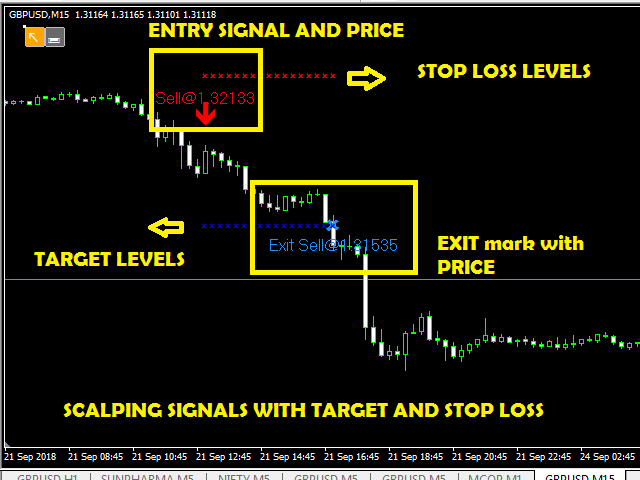

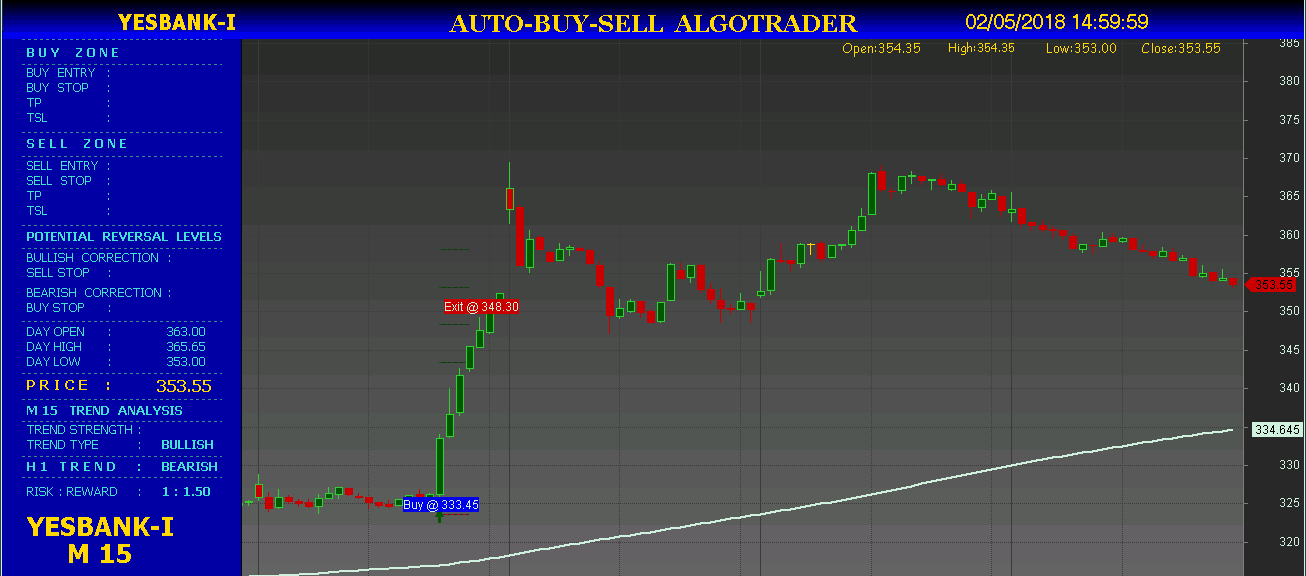

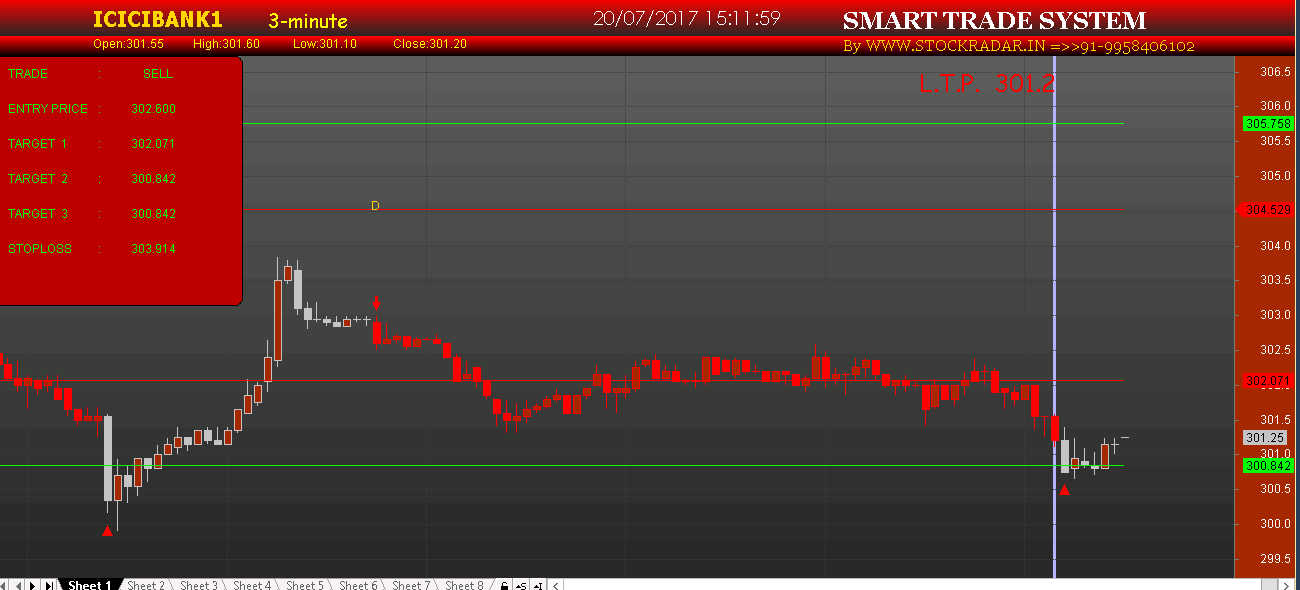

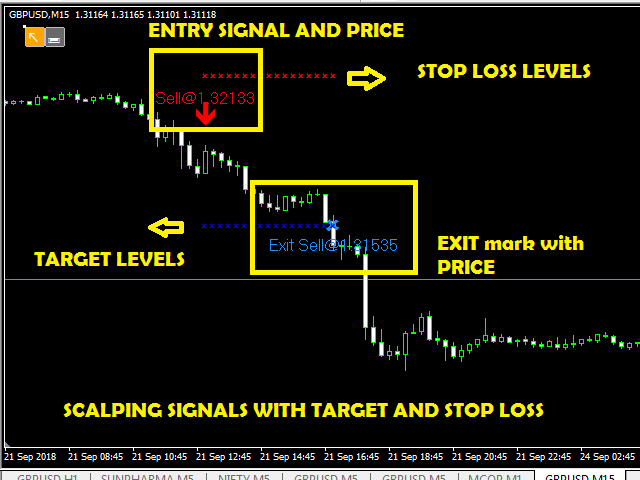

BUY SELL SIGNAL SOFTWARE

CONTACT : 91-9958406102

[email protected]

http://www.stockradar.in/

check out below:

https://www.stockradar.in/

https://www.stockradar.in/robot-scalper/

https://www.stockradar.in/auto-buy-sell-signals-software/

https://www.stockradar.in/mt-4-intraday-software/

https://www.stockradar.in/smart-scalping-multi-systems/

https://www.stockradar.in/pro-trade-tools-bundle/

https://www.stockradar.in/mt-4-buy-sell-systems/

https://www.stockradar.in/reversal-zone-signals/

https://www.stockradar.in/multi-symbol-multi-time-frame-system-mt-4/

https://www.stockradar.in/multi-map-buy-sell-system/

https://www.stockradar.in/power-zone-scalping-mt4/

http://www.stockradar.in/trend-line-patterns-breakout-signals-system/

https://www.stockradar.in/auto-trading-strategy/

https://www.stockradar.in/auto-trading-strategy/robot-trading/

https://www.stockradar.in/forums/

https://www.stockradar.in/videos/

http://blog.stockradar.in/

If major highs and lows are not being made, see to it the intraday motions are large sufficient for the prospective reward to exceed the threat. For instance, if taking the chance of $0.10 per share, the supply or ETF must be relocating enough to give you at the very least a $0.15 to $0.20 earnings utilizing the standards over.